Note: this article was first published in 2018, but it still confirms my conclusions about stock rating and analysts. So, don't be discouraged by the charts' dates.

Note: this article was first published in 2018, but it still confirms my conclusions about stock rating and analysts. So, don't be discouraged by the charts' dates.

Every experienced investor knows about the impact of analysts’ ratings on the stock actions. The next agency or the bank, like Deutsche Bank, RBC Capital Markets, Piper Jeffrey, issues the stock analysis, and, based on their ratings and recommendations (buy, hold, sell, upgrade, downgrade, overweight, market perform, market underperform, neutral…), many stocks experience jumps in investors’ activity.

What Zacks Investment Research does is simply average the summary of ratings that were issued at the same time by many analysts. Zacks issues an Average Broker Rating (ABR) or “Zacks Consensus Estimate”, basing it on several Wall Street analysts’ recommendations with a simplified 1 to 5 scale where 1 represents Strong Buy and 5 Strong Sell.

In the various online articles, you may find the words predicting, promising, estimating, or anticipating.

Basically, each Wall Street analyst pretends to be some kind of a “small Nostradamus”, and Zacks collects those predictions and averages them down. The paradox after all those estimates is the fact that investors tend to believe that the predictions are very close to reality, and the Wall Street kids have access to inside information and know more than the average investor. I am talking not only about single investors but also about the investment firms that make the sharp moves right after the rating is released.

While every educated investor (including institutional) understands that every prediction, even based on some crunched numbers (and a few other components – read below), is still only a prediction, somehow the ratings posted on the Internet have a big impact on the stock moves. It changes the investor's mood and corresponding reaction to the stock buying/selling decision.

My small research presented below proves how wrong those Wall Street kids can be. It can cost you! You lose the opportunities to make money after the wrong downgrade, or have chances to lose money on the wrong estimate of future gains.

You could find the stock recommendations on opposite sites: some recommend buying, but others recommend selling the same stock at the same time. What in the world is wrong with this picture?

I have been monitoring the stocks’ scores for a while until I was so disgusted that I had an urge to share my thoughts with fellow investors.

Let’s see the logic behind the XYZ stock recommendation by a regular analyst (let’s call him Bob Smart) from the ABC bank or financial agency.

Every good analysis involves crunching the numbers, carefully reading the CEO’s statements, SEC Forms, hopefully talking to the company’s executives, analysis of the industry at a certain time, competition, finances, etc., etc. So, Bob spends time on stock analyses based on the data that is available in his financial organization (often collected by the team). After a few days or weeks of sweating and consuming pounds of coffee, Bob finally comes to his conclusion about that XYZ stock. (I am probably simplifying the process.)

Please keep in mind that Bob’s conclusion is mostly based on past actions and current market conditions. There is no way Bob can predict what will happen with the market or this particular stock in the future. I hope you agree.

What does it mean? Every analysis and issued “recommendation or rating” of the stock is more opinion or an educated guess than fact. Often it is called properly: forecast.

I also believe that there is no way that two different analysts will go through the available data in two different companies' data and will come to the same numbers and recommendations – there is a lot to consider. I am talking about the situation when the same stock receives the opposite recommendation from two analysts. I think to myself: how crazy it is! Does each opinion represent the actual financial situation of the single stock? No way…

If this is the case, why do the majority of the investors rely on those “educated guesses”? Only because they “get used to” or because they believe that the analysts know more? Do they trust the names like UBS, Barclays to rate their stock of interest?

It is hard to say, but here is what I have found: the educated guess in most cases remains the guess that proves the analysts wrong.

My 20 years of investing taught me to stay away from this kind of stock unless you are in the swing trading mood, when the timing and the market news mean more than valuations. As you can find from my previous article, since I invest mostly in dividend stocks, this approach requires keeping the stocks for a long time in order to collect the dividends. I still do swing trading with about 5-7% of the liquid portfolio.

You also know that I use the Finviz.com site to get the stock information at a glance. In my examples below, I will use the charts from the same site. The process of stock research includes considering multiple financial parameters (or valuations), and each of them gives you the base for the overall stock valuation. While I do rely on those parameters, as well as the Wall Street folks do, I mostly rely on the stock charts that “tell the story” better than any P/E or cash flow.

Let’s start with well-known stocks. Philip Morris International (PM). At the bottom of the chart, you may find the downgrade of the stock issued by the well-known financial organization BofA/Merrill. The date of rating: January 4th, 2017, when the stock was at $90.42. Let’s take a look at the chart. For the less than 2 months since the recommendation, the stock gained $19.8 (at $110.22), which corresponds to a 21.9% gain.

If you were to sell the stock based on that “educated guess”, you would miss the outstanding opportunity. What amazed me is that these facts are not highlighted in the investment community. Who would want to blame BofA/Merrill?

Click to zoom in.

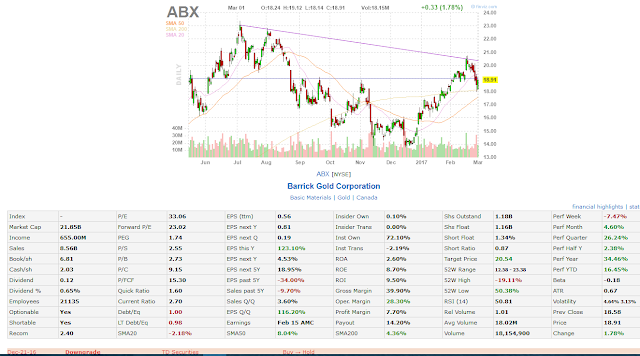

The next stock is Barrick Gold Corporation (ABX). The stock was downgraded on December 21st, 2016, by TD Securities when the stock was at $14.6. Let’s take the same two-month period and look at the value of the stock on February 21st: $20.11. The stock has added $5.11, which represents a 37.7% gain!

Bob Smart was wrong again.

The next chart is Tanger Factory Outlet Centers (SKT). Bob Smart (Jefferies, in this case) was obviously excited to see the jump from $35 to $36.73 within a few days (end of December –until January 3rd). So, naturally, he has upgraded the SKT from Hold to Buy with a target of $42. Guess what? Within two months, the stock lost $3.55, which corresponds to a 10% loss.

Click to zoom in.

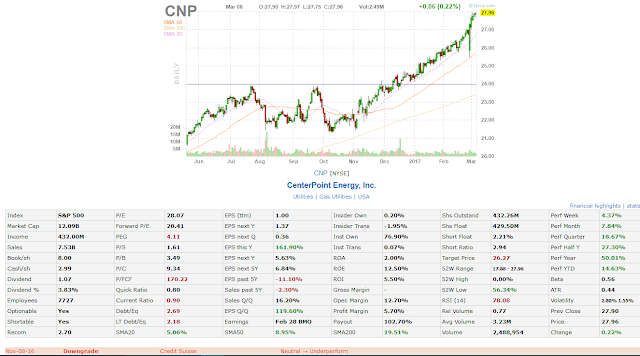

Even a respectable company like Credit Suisse has failed to predict the stock performance. Let’s take a look at CenterPoint Energy, Inc. (CNP). The stock was downgraded from Neutral to Underperform (!) on November 8th, 2016, when the price was $23.41 at the opening. This “underperforming” stock has gained 19.4% by March 6th.

Click to zoom in.

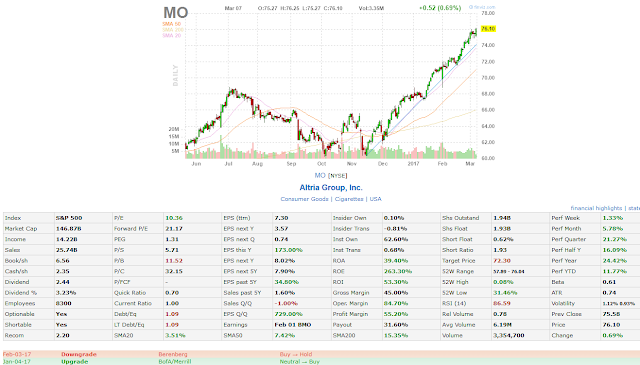

I would not say that the stock rating by the analysts is always wrong (see the chart below for Altria Group (MO) – the BofA/Merrill rating in January). Breaking the new high through the buying point on good volume manifests itself. If you try ten times, you might be right at least once.

Click to zoom in.

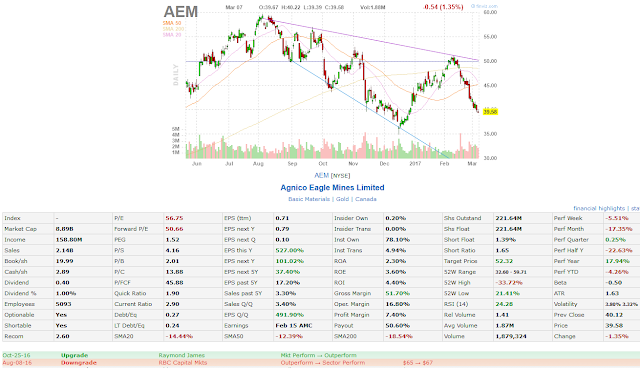

Still, there are many failures in predicting the stock moves, like the one below. Anglo Eagle Mines (AEM) was upgraded by Raymond James on October 25 when the stock closed at $49.94, only to drop to as low as $35.05 on December 15th ($14.89 loss), which equals -29.8%.

And one more (I promise this is the last example): Kimberly-Clark Corporation (KMB) was downgraded by Barkleys on January 9th from $125 to $109 when the stock was at $114.64. As you can see below, the stock extended to $133.64, which represents a ~16.6% gain.

Click to zoom in.

Frankly, you can find hundreds of failed predictions by well-respected brokerages. Just use Finviz.com to see for yourself.

Zweig Group mentioned a study of 250 financial analysts in which more than 90% believed the best way to evaluate a company is to “arrange the facts into a compelling story.” Portfolio managers have based major decisions on what feels right. Professional traders sometimes move billions of dollars in and out of stocks based on gut feelings and some results of a stock analysis published by major financial outlets. Except for purely random chance, none of this produces long-term benefits.

Do you need to hear more?

At one point, I thought to collect the data and find out which brokerage is the most correct (or most wrong) in their stock estimates, but then I had a second thought because too much time and data are required to process.

In summary, I believe that the stock rating, even by Zacks, which averages down many analysts’ forecasts, should not be taken as a basis for stock trading. There are always opposite points of view on the same company's stock. My argument is that the stock ratings should not be the basis for serious decisions, but rather just one more point of consideration if it supports your due diligence.

Be careful!

Disclaimer: This article is intended to provide information to interested parties. As I do not know individual investor circumstances, goals, and/or portfolio concentration or diversification, readers are expected to complete their own due diligence before following any investment strategies or rules mentioned or recommended.