November 23, 2018 (Edited in 2025)

November 23, 2018 (Edited in 2025)

LIQUID INVESTMENTS

LIQUID INVESTMENTS

My journey into the world of CEFs (closed-end funds) and BDCs (business development corporations) began with the insightful articles in the Seeking Alpha newsletter (free). These investment vehicles, with their unique benefits and potential for high returns, now form a significant portion of my liquid portfolio.

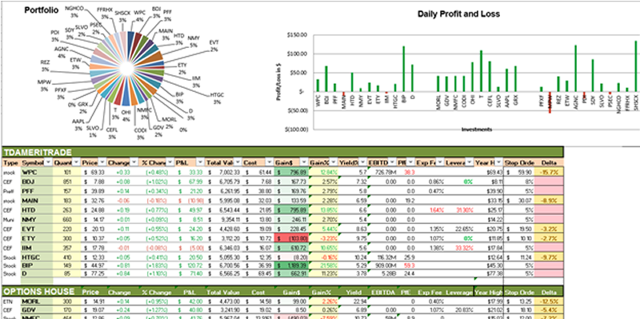

My investments include the dividend-producing investment vehicles such as preferred stocks, ETFs, MLPs, CEFs, and BDCs. Each of them employs different strategies to generate dividends and, therefore, has a distinct level of volatility and market dependency. This underscores the importance of closely monitoring the market and the Fed's moves, especially for CEFs that utilize leverage to generate high dividends and are highly interest-rate sensitive.

I have a few CEFs in my portfolio that have high fees - something that scares many investors away. Do I care if the CEF management charges a high fee? Yes, I do, but not so much. Let's see if the CEF has an 8.6% dividend and charges a 1.9% fee; the outcome is still a 6.7% dividend. Not bad at all. However, here is some good news: The management fee is already included in the balance, so my dividend remains 8.6%.

In my CEF evaluations, I look at several parameters beyond the fees. How about the leverage ratio? Is it too high compared to peers? Can I find a similar CEF that has less or no leverage and is less exposed to interest rate changes? What kind of bonds (if any) do they hold (B, BB, BBB rating)? When I add all those numbers to the spreadsheet, along with all other valuations (including discount/premium), I can choose what to trade.

One strategy that often sparks discussion is index investing. While it's not my preferred approach, I acknowledge that many actively managed mutual funds usually fail to outperform their respective indexes, leading some investors to rely solely on index ETFs.

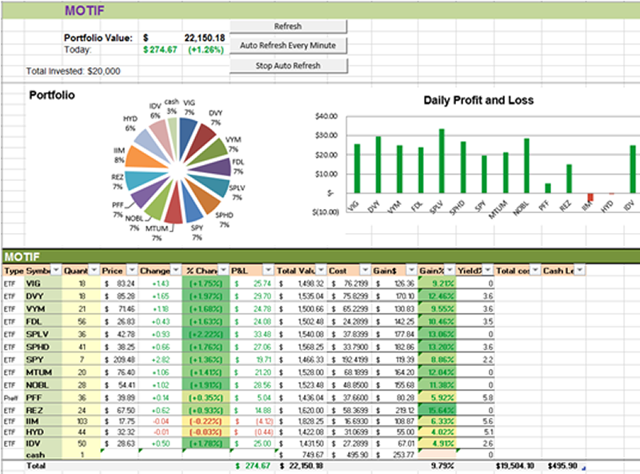

I have decided to give it a shot and build my own fund (the results shown below demonstrate the performance since February 2016). The sense of accomplishment and satisfaction that comes with seeing this fund grow and perform well is truly inspiring and motivating.

My goal was to use the index and some sector ETFs that have matched or outperformed the S&P 500 and/or Dow Jones over the last 5 years, with low fees (no more than 0.5-0.6%). The second goal is to generate at least 3.0% of dividends, so I have added PFF and IIM to help with it. I thought it would be better to invest $ 20,000 in this "fund" instead of keeping cash in the bank. I have invested $19,500 and left $500 in untouched funds to cover any future transactions.

Please review the results below. The 9.79% profit for less than 6 months is not bad for cash that could be losing its value in the bank. If, at the end of the year, the performance of my own "mutual fund" will still be attractive, I may add more money to it. Note: cash "gain" reflects the arrived dividends.

(click to enlarge)

Considering the rest of my liquid investments, I have also allocated about 8% of them for momentum trading. I am trading AAPL, LMT, NOC, and a few others that are not so dividend-rich but very good for swing trading.

While I haven't mentioned the bonds yet, I have just a few municipal bonds and diversified investments that include bonds. I like munis because they are more predictable and less vulnerable, in addition to being tax-free. This sense of predictability and stability in my bond investments gives me a reassuring confidence in my overall portfolio.

HOW I TRACK MY INVESTMENTS AND MANAGE A WATCH LIST

HOW I TRACK MY INVESTMENTS AND MANAGE A WATCH LIST

The investment research process has been significantly enhanced with new tools that aim to support both amateur and seasoned investors, as well as professionals. Personalized and easily accessible investment research, available on a mobile platform at a lower price (or free), is becoming the new standard.

One of the key skills that successful investors possess is the ability to meticulously track their investment returns and maintain a 'buy' list. It's not enough to observe daily fluctuations in stock prices. Experienced investors understand the necessity of evaluating and monitoring their portfolios over an extended period, analyzing and scrutinizing every past transaction.

Although online portfolio trackers are constantly adding new features and functionality, they still pale in comparison to software-based portfolio trackers. The majority of online portfolio trackers can only handle cash, stocks, mutual funds, and ETFs; they are limited in their customization options; and they offer fewer portfolio analysis features. Reports offered are generally less robust than those found in software programs.

One of the main advantages of online portfolio trackers is their convenience. They are typically less expensive and easier to learn and use. Online services offer the comfort of monitoring your portfolio on smartphones and tablets. There is no software package to install or update, and users typically do not need to worry about OS platform compatibility, providing a sense of ease and comfort in portfolio management.

Instead of discussing the fee-based investment software available online, I'd like to share some free or inexpensive resources that I have personally used and can recommend. These resources have empowered me to manage my portfolio effectively and make informed investment decisions.

On the desktop, I use the Finviz.com website that, beyond having an excellent stock screener, has one time-saving feature that I love: when you move the mouse over the stock ticker, the window with the stock chart will immediately pop up, in addition to a plethora of other fundamentals for each stock that are right there - no calculation is needed. I also use the modified spreadsheet (read below), which includes several key fundamentals, live quote updates, and color indicators.

The Investment Tracking Excel spreadsheet, in particular, allows me to view stock changes in real-time (on-demand or auto-refresh), reflects the difference between the year's high and today's price, includes the target price and deviation from it, and calculates total investments. I have also added the Stop Order price entry and the deviation from it. I only need to fill out a few cells, and the spreadsheet takes care of the rest. Very useful and more informative than the original Yahoo Portfolio or any other similar service.

The Watch List Excel spreadsheet includes many fundamental metrics (such as Yield, EBITDA, P/E, etc.) and begins with the indexes at the top of the page. It reflects my "virtual" cost when I started tracking specific stocks, showing current volume, year high, and delta (deviation), as well as my target price and the delta between them. I have recently added the average volume and pop-up indicators that reflect higher volume than the average.

Both spreadsheets are based on the Excel Scout spreadsheet for investments that was offered free (by a certified Microsoft Excel Expert). My current spreadsheet is designed to utilize Google Finance data and includes Excel macros that allow for manual or automatic quote refreshes. I have heavily modified it by creating a Watch List and Portfolio Tracking feature, as well as adding more parameters and color indicators. It looks nice and is editable (except for macros) to your taste: for instance, you may want to add day high and low. You're welcome to use it too, if you don't mind. Just email me, and I will attach the file and explain the settings to you. If you are generous enough to reward my hours of modifications and tweaking, I would appreciate your donation (through PayPal).

INVESTMENT TRACKING

INVESTMENT TRACKING

![]() Google. You can use the spreadsheet hosted on Google Drive to track your investments. There is nothing too complicated, and you can spend time modifying a spreadsheet to your liking without spending a dime. With your small donation, I will share the comprehensive Google spreadsheet that can be reused with your stocks. I have added several valuable calculations that help me make a trading decision in many instances.

Google. You can use the spreadsheet hosted on Google Drive to track your investments. There is nothing too complicated, and you can spend time modifying a spreadsheet to your liking without spending a dime. With your small donation, I will share the comprehensive Google spreadsheet that can be reused with your stocks. I have added several valuable calculations that help me make a trading decision in many instances.

![]() Google Finance Portfolio/Watchlist has a simple interface and is easy to use and update. You must have a Google account.

Google Finance Portfolio/Watchlist has a simple interface and is easy to use and update. You must have a Google account.

![]() Investing.com. This website offers a ton of data, portfolio tracking, and excellent charts for free. You can add multiple stocks to one chart for comparison. The chartmill.com is a website that I highly recommend. It offers a wealth of valuable screening tools that can enhance your stock-picking skills.

Investing.com. This website offers a ton of data, portfolio tracking, and excellent charts for free. You can add multiple stocks to one chart for comparison. The chartmill.com is a website that I highly recommend. It offers a wealth of valuable screening tools that can enhance your stock-picking skills.

![]() The PersonalCapital.com site is designed for individuals who are approaching or have already entered retirement years. You can add all your investments from different sources, including credit cards, and the site will track your investments with informative reports about cash flow, as well as an analysis of your chances for a safe retirement.

The PersonalCapital.com site is designed for individuals who are approaching or have already entered retirement years. You can add all your investments from different sources, including credit cards, and the site will track your investments with informative reports about cash flow, as well as an analysis of your chances for a safe retirement.

![]() Mobile Tracking. These days, everyone has a smartphone. You can use it to your advantage and track/manage your portfolio while you have no access to the desktop. First of all, you can upload your spreadsheet to a smartphone or tablet and use it in the same way as on the desktop, but I doubt you will find it always usable enough. Instead, use available applications from Google Play (if you have an Android phone) or iTunes from Apple.

Mobile Tracking. These days, everyone has a smartphone. You can use it to your advantage and track/manage your portfolio while you have no access to the desktop. First of all, you can upload your spreadsheet to a smartphone or tablet and use it in the same way as on the desktop, but I doubt you will find it always usable enough. Instead, use available applications from Google Play (if you have an Android phone) or iTunes from Apple.

I have tried multiple apps on my Samsung Android phone, but stopped at the following: e*Trade, Schwab, Barchart, Yahoo Finance, and Seeking Alpha. They cover my needs very well in addition to Google Sheets.

![]() Morningstar Instant X-Ray.

Morningstar Instant X-Ray.

You can enter all your investments and check the total allocations. This is a handy tool for analyzing your asset allocation across different investments. As you know, some ETFs and CEFs hold assets from various industries with varying allocations.

This tool will allow you to view the concentration in specific industries, countries, or asset types. When I used it for the first time, I was surprised and had to adjust my portfolio accordingly. If you want to use it on a more comprehensive level with in-depth analysis, a premium option is available.

Free Excel Spreadsheet for a comprehensive Single Stock Analysis.

I suggest searching for investment apps on Google Play. Please feel free to choose what you think is best for your needs. The same advice applies to the Apple Store if you have an iPhone.

Key Takeaways

Key Takeaways

- Buying investments requires evaluation of fundamentals, charts, and comparison with its peers. You can use spreadsheets as a valuable tool.

- The dividends can be the game-changers.

- You have the chance to become your own fund's manager with careful allocation of different categories of stocks, ETFs, BDCs, and MLPs. Please look it over for your portfolio.

- Free resources can save you a few dollars. Please don't rush into spending them on costly investment software.

- My approach to investing may not be suitable for you, but if you find anything useful in my investment strategies, use them and improve.

- The world has changed. Could you change your diversification strategy? Investing only in stocks and bonds is very risky.

- Sound diversification is different for everyone and depends on financial situation, age, and investment experience. No strategy will perfectly align with the values or unique circumstances of any one investor.

- Not everything is gold, even if it is shining… Be cautious.

- Tangible assets are less susceptible to market crashes, especially if they are income-producing.

- My approach to investing may not be suitable for you, but if you find anything useful in my investment strategies, use them and improve.

Author's Note: I have several long positions in the stocks shown in the snapshots (except the watch list), but I in no way suggest them for your portfolio. Do your own due diligence. I don't have any affiliation with the websites or businesses mentioned, and I don't intend to promote them. I also do not sell investment software, but rather share it "for free" with fellow investors, since I did not pay for any part of it.

This article is meant to provide information to interested parties. As I am not aware of the individual investor's circumstances, goals, and/or portfolio concentration or diversification, I would like to let you know that readers are expected to conduct their own due diligence before following any investment strategies or recommendations mentioned or made.