When would you like to purchase the annuities?

When would you like to purchase the annuities?

As I have mentioned in the first part of this article, annuities make the most sense for pre-retirees and retirees who want to minimize worry about bear markets in retirement: a precise stream of income, no matter how markets perform. Annuities, in short, represent certainty in an uncertain world.

Why does it make sense to buy the annuities a few years before retirement? In my case, I’ve also invested in some annuities in 2015 and retired in 2018. Starting from the following year (in May 2019, after 5 5-year of waiting period), I will be able to begin my yearly guaranteed withdrawals.

Why did I buy that annuity in the first place? The answer is simple (and this is the only reason why annuities are still worth consideration): I wanted guaranteed income with no headaches for the rest of my life. There is another effect of having annuities, more mental than financial: it provides the safety of a guaranteed income (like Social Security, to some degree).

Is it worth paying so much extra to the investment institution to achieve this simple goal? The answer is: that it depends.

First of all, it depends on what kind of annuities you are willing to buy. Each of the five types (see the table in the first part of the article) has different conditions and different fees.

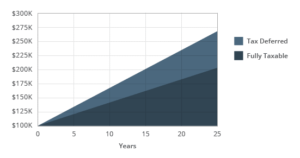

Secondly, it depends on the funds you are using: if you are buying with non-qualified funds (regular investment account) or with qualified funds (such as an IRA/Roth IRA). I used some IRA funds, and later I found that it was another misguided move, since, for instance, the variable annuities in their core are already tax-deferred.

A tax-deferred annuity is a plan in which income tax on an original deposit of investment income is not charged during the investment period. The tax liability is deferred until the owner or beneficiary begins to receive (or access funds) periodic payments of earnings from the invested funds.

Thirdly, it depends on when you are going to retire. As you can see, it makes sense to buy:

Thirdly, it depends on when you are going to retire. As you can see, it makes sense to buy:

- If you need money right after you have retired and cannot rely on the SSA income only. Buy, keeping in mind a waiting period for starting withdrawals.

- If you can handle your living expenses without those annuities for several years, buy right before your retirement and start withdrawing in a few years.

Factors that affect the size of annuity income: Type of annuity selected, amount of money invested, age, sex (male/female), payment guarantee selected (and whether or not you want the death benefits included).

One important question arises from this discussion: what if you are experienced enough to generate an income with your available cash in excess of 5-6% per year (no matter market volatility)? Does it make any sense to buy annuities? The quick answer is NO. You will save on hefty fees, not to mention applying compounded interest (DRIP), and earn even more.

Some Tips on Buying Annuities

The right kind of annuity can be a functional part of any diversified portfolio just as bonds are.

Consider annuities if you:

- are in a high tax bracket;

- have exhausted other forms of tax-favored retirement savings, like 401(k)s and IRAs;

- want to own more bonds, especially corporate bonds;

- If you are close to retirement or already have retired;

- If you have limited financial management experience and can’t or don’t want to manage part of your funds actively.

If you are 8-15 years from the retirement date but still considering guaranteed income with annuities, consider ensuring you receive 5-6% interest and some step-ups on anniversary dates, so your withdrawal rate will increase over time until you begin taking withdrawals. I still recommend waiting and investing in the indexes instead.

If you are 8-15 years from the retirement date but still considering guaranteed income with annuities, consider ensuring you receive 5-6% interest and some step-ups on anniversary dates, so your withdrawal rate will increase over time until you begin taking withdrawals. I still recommend waiting and investing in the indexes instead.

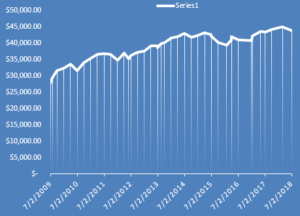

The picture above represents the investment in the MetLife variable annuities with a 6% yearly step-up option. As you see, over time, it has increased in value compared to the previous examples. The initial investment of $27,800 in 2009 has risen by ~57%. At the same time, the fees collected by MetLife were not so pleasant.

Conduct thorough research on the fees and find the lowest-fee annuities.

There are hundreds of annuities on the market. They typically offer generous payments compared to other investments, such as bonds. Still, many have substantially higher fees, and their costs — reflecting today’s ultra-low interest rates — are no longer as attractive as they once were. Annuities are likely to become more attractive in the future as interest rates rise, which is widely expected.

Tip: Six questions to ask when buying annuities.

If one of the reasons to invest in annuities is the fact that they are tax-deferred, perhaps don’t be a fool by buying high-fee annuities, as they will destroy the benefits from deferring taxes or sidestepping market declines.

Despite the risks, you can do well with a tax-deferred annuity. Follow these eight rules from Forbes. Or skip to the summary down below.

#1. Buy from a no-load fund company. Outfits like Fidelity, T. Rowe Price, and Vanguard don’t have to pay commissions to sellers, so their annual fees are lower, and they don’t charge a “surrender charge” if you take your money elsewhere a few years later.

#2. Keep expenses low. Compare the annuity account you like to a low-cost fund that invests in the same sort of securities. Don’t pay more than 0.5% extra per year to get the annuity.

#3. Don’t buy stocks. Put bonds in your annuity. Their high current income makes the deferral feature valuable.

With stocks, you don’t get many deferrals that you couldn’t have had merely by buying an index fund in your taxable account and standing perfectly. Worse, an annuity will convert stock appreciation taxed at favorable capital gain rates into ordinary income taxed at high rates.

If you are tempted to get equity exposure through a deferred annuity, resist. Instead, consider a stock index fund, such as SPDR (SPY) or the Schwab Total Stock Market Index Fund (SCHB).

#4. Skip the guarantees. Vendors of high-cost annuities create complex products that have you getting protection from market declines in return for giving up some of the gains in up markets. These are always bad deals. Of course, there’s no way for you to know that unless you have two actuaries and a computer programmer working for you.

There’s a better way to protect yourself from the next market crash: Don’t put so much money in stocks. If you can’t sleep at night, switch some of your retirement savings into medium-term bonds.

#5. Put annuities last on your shopping list. First, fill up your 401(k) or a self-employed retirement plan to the max. Next, see what you can do with IRAs, even of the nondeductible variety.

Third, could you consider investing in municipal bonds? Not too much, but some. Tax-exempt bonds are more potent than annuities at tax time. They exempt you rather than a deferral.

Then, and only then, should you consider buying annuities.

#6. Stay put. It takes a while for the cumulative benefit from deferral to overcome the cost drag of a deferred annuity. For a high-bracket investor holding corporate bonds, I figure, it takes more than a decade. And that’s with a low-cost annuity.

#7. Think about liquidity. If you need the money back before you turn 59-1/2, you’ll have that tax penalty: a 10% surcharge, on top of regular income taxes, on any earnings.

A separate liquidity issue concerns back-end charges levied by the vendor. You avoid this problem by not buying products with these charges.

#8. Use for the intended purpose. The original idea behind deferred annuities was to have your money grow untouched for several years (the “accumulation phase”) and then be converted into a lifetime monthly annuity (“annuitization phase”). It’s not a bad idea.

Suppose you invest $100,000 at age 50 in junk bonds. It grows to $200,000 when you’re 65. You could cash in the policy, paying tax on $100,000 of ordinary income. Better: use the $200,000 to buy a so-called immediate annuity paying a fixed monthly sum for as long as you live. A 65-year-old male would receive approximately $1,200 per month from this lump sum.

The exchange from deferred to immediate continues your tax deferral if you do it right. (It’s called a Section 1035 exchange.) Some of that money you put away when you were 50 is coming out when you’re 80, having benefited from 30 years of tax-deferred compounding.

Remember, though, that an annuity only delays the reckoning with the tax collector. In our example, you’d collect $14,400 a year but pay tax on $9,400, as you receive a tax deduction of $5,000 per year. Over the course of 20 years, you recover your original purchase price with this deduction.

SUMMARY

Folks, please understand that when you put your hard-earned cash into the insurance company, it invests it in the open market. When you receive your money back, you typically receive pennies compared to what the insurance company receives.

In most annuity contracts, you are guaranteed a certain amount of annuity income, and if you choose the right option, it will be an income for the rest of your life. Regardless of your choice, you will be required to pay fees and commissions for the guarantee.

Did I mention that any website that sells annuities never highlights the disadvantages?

Do your due diligence (more than usual) to find the benefits of certain annuities that outweigh the negatives.

Read more about another aspect of annuities.

Would you happen to have any feedback? I really appreciate any help you can provide.

DISCLAIMER:

I am not a financial professional, so I have expressed my view on the subject based on my own experience and research. Investors are expected to conduct their own due diligence and/or consult with a professional who understands their objectives and constraints. I have utilized various resources on the Internet and genuinely appreciate all the authors whose thoughts were included in the article.

If you like what you've read and would like to be notified about future articles, please don't hesitate to drop me a note.