February 20, 2024

![]() An annuity is the most hated investment vehicle, yet annuities are still being sold.

An annuity is the most hated investment vehicle, yet annuities are still being sold.

- There are many negative points in this type of investment, but the only positive could be the major one at a specific period of your life.

- Be aware of the complexities of annuities. And I emphasize again: this is one of the most complicated investments.

- Get educated before choosing any annuities for your portfolio.

- This is a lengthy article, so be patient if you want to learn more.

I would like to begin with an introduction to annuities, as presented by S. McDonald from the Oxford Club. While I appreciate his articles on retirement, I don’t like the cost of his offered services, but that is another topic. This is when he got it straight:

“Down here in the retirement belt, we have these annoying things called hurricanes. They appear between June and November, causing various problems.

Most of the damage they cause is due to flooding. Winds are a problem, too, but the flooding will definitely ruin your whole day.

That's why insurance companies have what are called "flood zones" - areas they predict will flood when a storm comes ashore.

A funny thing happened during the last two hurricanes that hit our town. Every area the insurance folks said would flood, in fact, did. And the areas that were "X" zones (those they said wouldn't flood) didn't.

There are two key points to take away from this.

One: If you can, avoid any areas that aren't "X" zones. Believe me, that will make your life a whole lot easier.

And two: Never bet against an insurance company's predictions. If it says it will happen, it will.

This brings us to the topic: annuities.”

![]() I acquired my first annuity about 12 years ago. Frankly, I had no clue about this type of investment. I had some investment experience with mutual funds and even some stocks, achieving a certain degree of success as my accounts grew (primarily due to my consistent cash additions), and the same degree of misfortune (because I have been losing money more often than making a profit).

I acquired my first annuity about 12 years ago. Frankly, I had no clue about this type of investment. I had some investment experience with mutual funds and even some stocks, achieving a certain degree of success as my accounts grew (primarily due to my consistent cash additions), and the same degree of misfortune (because I have been losing money more often than making a profit).

I don’t recall who recommended that investment “adviser”, but one day, the man in his 60s came to my house with a lot of promises about the annuities.

I don’t remember Frank’s sales speech (somehow, I still recall his name). Still, it has resulted in a significant investment in annuities – mostly my 401(k) rollover funds, which were not previously invested in stocks or mutual funds. At that time, I did not even touch the real estate investments, so I decided to invest my funds “wisely”.

Note: Annuities funded with 401(k) rollover or IRA rollovers are qualified plans (tax-deductible) that allow an insurance company to create an IRA annuity where you deposit your retirement funds directly.

I bet that I made this man happy for several days, at least, as he anticipated juicy sale commissions.

Now, reflecting on my past foolishness, I blame myself for being so naïve. But you live and you learn. Unfortunately, I learned from my own mistakes.

The core of annuities (as an offered investment choice to the buyer) is a presumption that the buyer will die before the investment company pays off all the money he has invested upfront. You, as a buyer of annuities, presume the opposite: the insurance company is wrong about when you will go to the “better world”.

The core of annuities (as an offered investment choice to the buyer) is a presumption that the buyer will die before the investment company pays off all the money he has invested upfront. You, as a buyer of annuities, presume the opposite: the insurance company is wrong about when you will go to the “better world”.

The insurance companies’ business is all about their calculations and statistics regarding the average life span. They assume you will die earlier, so they may keep the rest of the invested money and can stop paying your monthly income. Otherwise, how can they stay profitable?

As S. McDonald indicated, “You can bet the insurance companies have figured out how to work that option to their advantage as well. Unlike flood zones, making repairs after the fact is not an option with annuities.

The bottom line is that insurance companies rarely lose. You have as much of a chance of beating them at the annuity game as people who live in flood zones without flood insurance have of "beating" the flood...

They'd better own a boat.”

When you buy an annuity, you are insuring your future income along with your capital. As you know, most insurance products are expensive, and an annuity is not an exception.

In general, annuities are considered dreadful products; however, depending on your situation, they may fit well into your retirement portfolio.

Suppose you consider annuities but still have doubts about whether you're making the right decision. Consider also a new rule that was passed by the Department of Labor in 2016. The rule makes the salespeople and investment advisers fiduciaries. A fiduciary has a legal responsibility to do what’s best for their client and not for themselves or their companies.

If you purchase the annuity, ensure you are working with a fiduciary. Unfortunately, most insurance and stockbrokers are not fiduciaries. If they sell you any financial product that is “suitable for your situation” but costs a lot in the long run, it is your own fault.

I have learned that after the rule was passed, the sales of annuities fell by more than 15%. Guess why? Many investment brokers want to avoid the trouble if a customer complains, not to mention the increased amount of documentation that needs to be prepared.

At first, the investment broker “sings a sweet song” about guaranteed income during your retirement years. Isn’t it what all of us want?

You bet I want it now, as I have just said goodbye to daily traffic, office politics, and lazy bosses, adding about 9 hours a day to my personal life.

When you think about that sweet promise of income from annuities, you assume that this is a good idea and that you will be doing a favor to yourself in the future. The problem is that when it is too good to be true, it usually is!

You must know about the real cost of it in the long run, until the annuity payments start arriving at your mailbox. Furthermore, learn about the recurring expenses during your retirement years and after your passage to a “better world”.

![]() Let’s Get Educated About Annuities

Let’s Get Educated About Annuities

After reading the previous two chapters, you may ask why you should even learn more about annuities if they're the worst kind of investment?

After reading the previous two chapters, you may ask why you should even learn more about annuities if they're the worst kind of investment?

Don’t rush; annuities can still find a place in your retirement portfolio if you know how to use them properly.

As I mentioned in my previous articles (see the Investments category), I have made numerous mistakes as a novice investor. Some of them are associated with annuities bought a long time ago without a thorough understanding of the conditions. However, now that I have retired, I am glad to have several of them that will add a significant amount to my family's income.

Annuities are a complex investment vehicle that can be described by various formulas, depending on the type of annuity. If you “Google” the words “annuities equation” under Google images, you might be frightened, as there are so many of them, and they seem pretty complicated. It would look like this:

Don’t worry, I am not going to check your math skills, but rather try to use plain English.

There are five types of annuities, and which one is better for you depends on several variables, including your risk orientation, income goals, and when you want to begin receiving annuity income:

| ANNUITY TYPE | PRO | CON | FEES |

| Fixed Annuity | Straight forward | Pay-less | None |

| Variable Annuity | Offers maximum stock market exposure | May lose principal | Highest |

| Fixed Indexed Annuity | Market Exposure with no risk | Participation rates, etc., diminish the potential for gain | Mid-level |

| Immediate Annuity | Pay highest | Must sacrifice principle | None |

| Deferred Annuity | Cheaper and enables the timing of payments | Must sacrifice about how long you will wait for income | Mid-level |

![]() Any annuity is an insurance contract that offers guaranteed income, often for life, and sometimes with small capital appreciation. An annuity is designed to supplement your income (like Social Security, stocks/bonds/mutual funds, etc.).

Any annuity is an insurance contract that offers guaranteed income, often for life, and sometimes with small capital appreciation. An annuity is designed to supplement your income (like Social Security, stocks/bonds/mutual funds, etc.).

You may allocate a portion of your portfolio to it, but don’t invest a significant amount, as an annuity is essentially illiquid (similar to a long-term CD).

There are several key considerations to consider before buying annuities. But the first rule of thumb is “Learn the slang and the meanings”.

Learn the conditions: withdrawals, early withdrawals, terms, early fees, how the interest is compounded, if any, what the guarantees are for life or after passing away, and the most critical measure -- the fees that can eat away a big chunk of principal.

When considering the death benefits associated with a contract, be aware that they will incur increased yearly fees.

Most of us dislike reading the fine print in the Terms and Conditions. It is the case when you have to change your attitude and approach. If you are confused by all the complex definitions, please don't hesitate to seek professional advice, but not from the salesperson who is trying to sell annuities.

Don't be scared by the definitions. If you could be patient, you will get it, I promise.

| Annuitant | The person, usually the contract owner, to whom an annuity is payable and whose life expectancy is used to calculate the income payment. |

| Annuitization | The conversion of the annuity principal to a higher, often lifetime income stream. |

| Beneficiary | A person or persons who receive payments in the event of the death of the annuitant. |

| Contract Fee | An annual fee, among others, is paid to the insurance company for administering the annuity. |

| Contract Value | The cash value of the annuity. |

| Death Benefit | The payment to the annuitant’s beneficiaries in the event of their death. |

| Free-Look Period | A specified number of days (e.g., 10 days) during which an annuity contract owner may revoke the purchase of an annuity without penalty. |

| Living Benefits | The guaranteed lifetime income is paid on lifetime income annuities. |

| Period Certain | A feature on some annuities that pays income only for a specific time (e.g., 10 years). |

| Roll-up rate | A bonus rate is paid to buyers of many variable and fixed indexed annuities who refrain from withdrawing income for a specified period, usually at least one year. These rates tend to be very high. |

| Split Annuities | A combined purchase of two annuities, usually involving an immediate annuity, to boost an annuity income stream. |

| Subaccount | The name "mutual funds" is often offered in variable annuity contracts. |

| Surrender Charge | The cost to a contract owner for sizable or complete withdrawals from the annuity contract before the end of the surrender charge period, typically 7 to 16 years. The earlier the withdrawal, the higher the fee. Many annuities permit annual withdrawals of up to 10 percent of the principal, and sometimes more, without penalty. |

![]() FIXED ANNUITIES: no-cost, modest, and guaranteed fixed interest investment offered by insurance companies. The interest rate is higher than that of bank CDs, with the option to defer income for several years or draw it immediately.

FIXED ANNUITIES: no-cost, modest, and guaranteed fixed interest investment offered by insurance companies. The interest rate is higher than that of bank CDs, with the option to defer income for several years or draw it immediately.

![]() VARIABLE ANNUITIES: usually, the basket of mutual funds with an option to capture not only guaranteed income regardless of market performance but also get some capital appreciation if the market performs well. The danger of losing the principal if the market performs poorly is a significant drawback. However, in recent years, investors have poured as much as $141 billion into variable annuities.

VARIABLE ANNUITIES: usually, the basket of mutual funds with an option to capture not only guaranteed income regardless of market performance but also get some capital appreciation if the market performs well. The danger of losing the principal if the market performs poorly is a significant drawback. However, in recent years, investors have poured as much as $141 billion into variable annuities.

![]() FIXED-INDEXED ANNUITIES: the annuities with a variable rate of guaranteed minimum interest benefits that are added to the contract value in the case when the market-based index (Russel 2000, S&P 500, etc.) is positive. A drawback: upside potential is “capped” by a so-called “participation rate” when your return in a rising stock market is trimmed (no matter how well the market performed). Juicy for insurance companies, right? This type of annuity is safer than variable annuities and allows for the capture of some level of potential market appreciation with downside protection of the principal.

FIXED-INDEXED ANNUITIES: the annuities with a variable rate of guaranteed minimum interest benefits that are added to the contract value in the case when the market-based index (Russel 2000, S&P 500, etc.) is positive. A drawback: upside potential is “capped” by a so-called “participation rate” when your return in a rising stock market is trimmed (no matter how well the market performed). Juicy for insurance companies, right? This type of annuity is safer than variable annuities and allows for the capture of some level of potential market appreciation with downside protection of the principal.

![]() IMMEDIATE ANNUITIES: The buyer gives the insurance company some amount of cash that will never be repaid in return for regular income payments until death. Income payments can typically be higher than other annuities because they are based on principal interest and also offer advantageous tax treatment. No fees are attached.

IMMEDIATE ANNUITIES: The buyer gives the insurance company some amount of cash that will never be repaid in return for regular income payments until death. Income payments can typically be higher than other annuities because they are based on principal interest and also offer advantageous tax treatment. No fees are attached.

![]() DEFERRED ANNUITIES: They delay payments until a specific date. In my case, as I described above, I purchased them in 2015 and will be able to make the first payment in 2019. Because the insurance company has several years to use your money for free and still charge the fee (!), the costs can be slightly increased (i.e. 5% step-up). These types of annuities may appeal to buyers who want guaranteed income in the future. Everyone’s situation is different. For instance, you have sufficient funds to support your life for several years, and you want the safety of annuities with a guaranteed income after several years when you need it.

DEFERRED ANNUITIES: They delay payments until a specific date. In my case, as I described above, I purchased them in 2015 and will be able to make the first payment in 2019. Because the insurance company has several years to use your money for free and still charge the fee (!), the costs can be slightly increased (i.e. 5% step-up). These types of annuities may appeal to buyers who want guaranteed income in the future. Everyone’s situation is different. For instance, you have sufficient funds to support your life for several years, and you want the safety of annuities with a guaranteed income after several years when you need it.

Let’s consider three major PROS of annuities:

- They are tax-deferred

- They guarantee the safety of principal (for some types of annuities) that will be paid off to your heirs after your death (if you choose that option for an extra fee).

- They guarantee a minimum rate and even some step-ups if you hold the investment long enough, regardless of interest rate fluctuations.

Other PROs:

- With certain annuities, you will never outlive your money

- An annuity may help you sleep better at night during your retirement years.

- Annuities can be integral to estate planning (i.e., death benefit guarantees, the appointment of the beneficiary to avoid probate, etc.)

Now, let’s review the CONS of this type of investment:

1) Long-term performance is ridiculously low (if any at all!). Investment companies use your money to invest in proprietary investment vehicles that cannot even be compared to the performance of the S&P 500. It is like comparing the speed of turtles with that of wild horses.

2) As I said above, it is an entirely illiquid investment with a hefty penalty fee for early withdrawal. You also cannot withdraw a lump sum from your annuity.

3) Yearly fees eat your money alive.

Example from AXA annuities:

- Total Investment Performance: $1,747.79

- Less: Contract Fee ($30.00)

- Less Guar withdrawal benefit for Life charge ($151.12)

- Less: Modified Death Benefit Chg ($74.25)

Net Investment Performance: $1,492.42

The result: AXA has stripped 15% from your annuity’s performance!

4) Getting more benefits (like death benefits) will cost you dearly for the duration of the annuity (see the second example below).

5) As you can see in the table above, you can lose the principal!

6) Time restriction on when you can start withdrawals.

7) Annuities limit how much upside you can make in a bull market, not to mention that the purchasing power is being reduced with inflation unless an indexed annuity is selected.

8) Possible loss of investment value due to an early death.

![]() I purchased another annuity in 2015, anticipating my retirement in a few years. The investment company will permit me to withdraw money no earlier than 5 years after my investment date.

I purchased another annuity in 2015, anticipating my retirement in a few years. The investment company will permit me to withdraw money no earlier than 5 years after my investment date.

Please pay attention to the time restriction notice. It plays a vital role in your retirement strategy.

Buying earlier than 4-5 years before retirement makes no sense. If I had invested my $ 150,000 in the S&P 500 Index fund, I could have generated a substantial return.

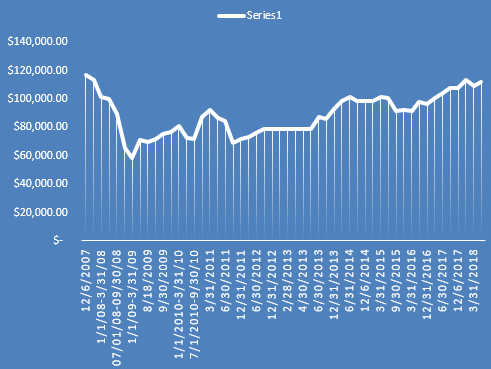

At the beginning of 2007, SPY had a value of around $140 per share, and today it is $291.7 (as of the middle of September 2018). It’s a 208.3% difference.

At the same time, look how my $112K Accumulator Plus account from AXA Investment has performed during the same years:

I have approximately $ 111.60 after investing for over 10 years.

Would you be happy with it? I missed the opportunity to earn a return of $233,296 for the same period if I had invested in SPY (S&P 500).

If I had been more knowledgeable at that time, I could have invested in preferred stocks, some CEFs, BDCs, and REITs that provide a nice income. With DRIP, I could be even better in shape. Even index investing could yield a significantly higher return.

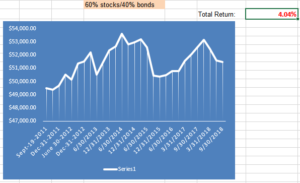

![]() Here is another example of an annuity from Delaware Life: Master Flex II Variable Annuity (see the picture below). Eight years of investment, adhering to the 60/40 rule, yielded a disappointing 4.04% return. This investment guarantees a lifetime income of 4%, including death benefits from the account value upon death, based on market fluctuations. Quarterly fees were averaging $220/quarter. Since acquiring this annuity, the company has charged $220 per quarter for eight years, totaling $ 1,760. Additionally, the company has invested that money in the open market and has been earning thousands more.

Here is another example of an annuity from Delaware Life: Master Flex II Variable Annuity (see the picture below). Eight years of investment, adhering to the 60/40 rule, yielded a disappointing 4.04% return. This investment guarantees a lifetime income of 4%, including death benefits from the account value upon death, based on market fluctuations. Quarterly fees were averaging $220/quarter. Since acquiring this annuity, the company has charged $220 per quarter for eight years, totaling $ 1,760. Additionally, the company has invested that money in the open market and has been earning thousands more.

Here is another example (click on image to zoom in):

Do you still feel warm about annuities?

![]() When would you like to purchase the annuities?

When would you like to purchase the annuities?

Annuities still make the most sense for pre-retirees and retirees who want to minimize worry about bear markets in retirement: a precise stream of income no matter how markets perform. Annuities, in short, represent certainty in an uncertain world. Continue to Part II of this article.

If you like what you read and want to be notified about future articles, please drop your info into the form (at the bottom of the page)